#1 In Payroll Tax Reduction And #1 In Employee Retention.

ATTENTION: Employers

The CHAMP Plan

Finally A Wellness Plan That Reduces Payroll Taxes While Increasing Employee Pay

Sanctioned By The IRS.

Transform Your Payroll Stategy

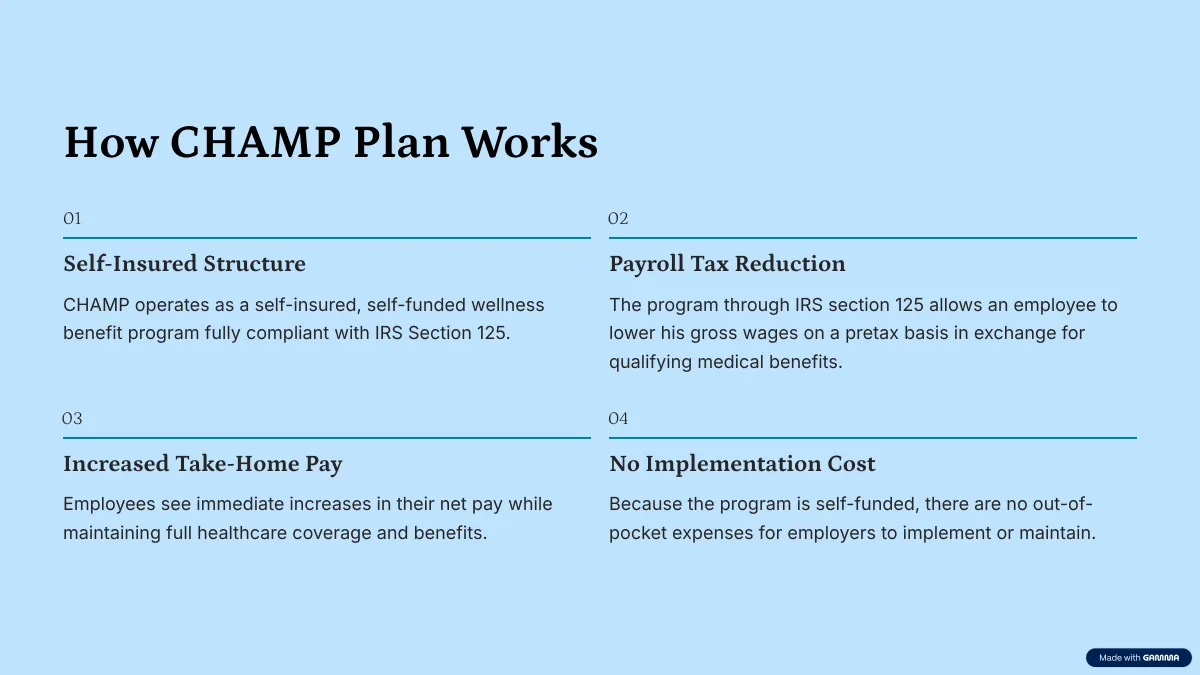

The Champ Plan Is An IRS Sanctioned Healthcare Benefit That is Self-Insured and Self-Funded.

Employers Save $573.60 per Employee per Year, While Employees Take Home An Average of $1500 More per Year. Because Champ Is Self-Funded, There Is Zero Out of Pocket For The Program.

Why Leading Companies Chooses CHAMP

10 K+

Companies Trust Champ

Over 10,000 Companies Nationwide Rely on CHAMP Plan for Payroll Tax Savings

100%

IRS compliant

Fully Compliant With IRS Section 125 Regulations

$0

Out of Pocket Cost

Zero Implementation or Maintenance Costs for Employers

Immediate Financial Impact

Employer Savings

Save $50 per employee monthly through reduced payroll taxes. These savings begin day 1 with immediate impact on your bottom line.

Employee Benefits

Employees take home an average of $125 per month without any reduction in benefits or coverage. Boosts retention giving them a proactive approach to health.

Employer Benefits

Reduce Payroll Taxes

Save $50 Per Employee Per Month.

100% Compliant

Sanctioned by IRS Section 125

Immediate Implementation

Start Saving On Day One With Seamless Integration Into Your Existing Payroll System.

Employee Advantages

More Money in Every Paycheck!

Employees take home an average of $1500 more per year. This increase comes from strategic tax optimization that benefits both employee and employer.

Increased take-home pay

Average $1500 Annual Increase In Net Income.

No Additional Costs

No Out of Pocket Expense for Employees.

Enhanced Benefits Package.

Doesn't Interfere With Major Medical.

STILL NOT SURE?

Frequently Asked Questions

Commonly Asked Questions Online

Question 1: How do you reduce payroll taxes for small businesses?

We use a Section 125 Cafeteria Benefit Plan, sanctioned by the IRS, that creates payroll savings for you the employer and for your employees both.

Question 2: What are payroll tax refund programs?

The Champ Plan does not refund the payroll tax back to you but rather it pays those tax savings to the employer on a monthly basis.

Question 3: Is payroll tax reduction legitimate?

Payroll tax reduction is legitimate. The Champ Plan adheres to Section 125 of IRS tax code and is sanctioned by the IRS.

Question 4: How much can I save on payroll taxes?

With the Champ Plan an employer saves annually $573.60 per employee. An employer with 100 employees on the plan will save $57,360 annually.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Want to work with us?

Retain your employee! Give them incentive to care about being proactive with their own health. Give them greater take home pay and benefits that don't interfere with major medical and no additional expense.

Copyright 2025. Dwight Christie Consulting. All Rights Reserved.